SDB Lakdaru Children’s Savings Account is the ideal start to securing a financially sound future for yourchild. Offering a higher interest and a host of features including medical insurance as well as rewardsthat include scholarships and a reward scheme that grows with your child, empowering them tosucceed. Speak to us today to help your child realize their dreams.

- A higher interest for a children’s savings account (View Rates)

- Hospitalization cover of up to Rs. 50,000/= valid for 01 year, for account holders who maintain a minimum account balance of Rs 50,000/-

- Private Hospitalization – Rs.5,000/= per day up to 10 days (maximum Rs.50,000/=)

- Government Hospitalization – Rs.3,500 /= per day up to 20 days (maximum Rs.50,000/=)

- An attractive rewards scheme for children who excel at the Grade 5 Scholarship.

- An attractive gift scheme based on savings balance as follows

WEF 16th June 2023

*Conditions apply

- A Lakdaru account can be opened for children below the age of 18 by a parent or guardian (Sri Lankan citizen) over the age of 18.

-

A minimum initial deposit of Rs. 5,000/=

-

Account holder's age should be under 13 years to be for be entailed to gifts.

- A duly filled account opening application

- Copy of the child’s birth certificate

- Copy of the national identity card / passport / driver’s license of parent or guardian

- Address verification document (i.e. copy of fixed utility bill, bank statement, etc) if current postal address differs from the national identity card or identification document

- Visit the nearest SDB bank branch

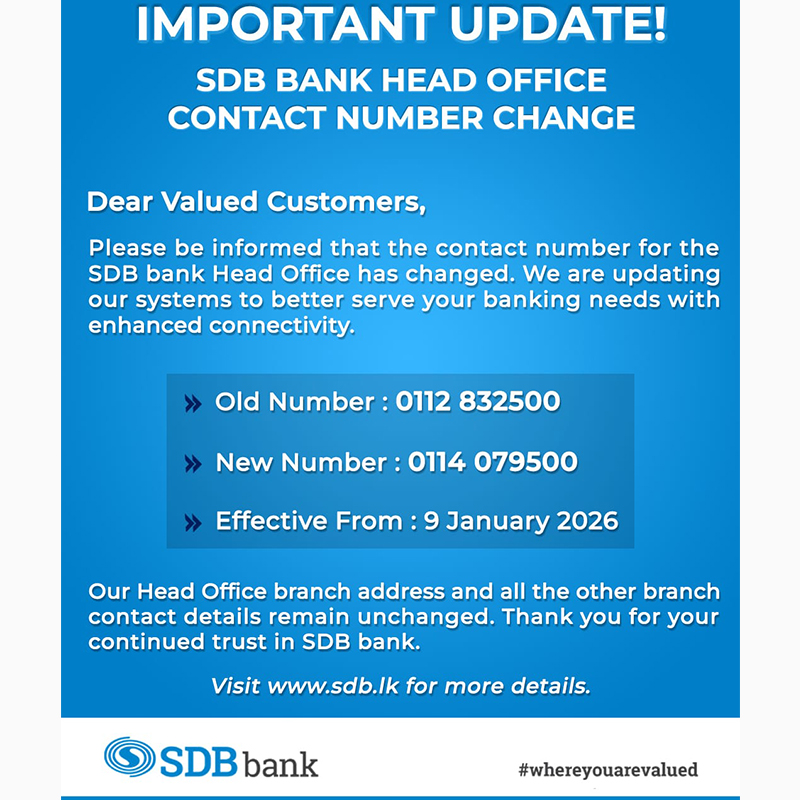

- Call our 24x7 call centre on 0115 411411

- Inquire now

Deposit liabilities have been insured with the Sri Lanka Deposit Insurance Scheme implemented by the Monetary Board on payment of applicable premium for compensation up to a maximum of Rs. 1,100,000 per depositor. - https://www.cbsl.gov.lk/en/sri-lanka-deposit-insurance-scheme

↑

↑