12-January-2025

In today’s fast-paced world, securing your financial future has become more critical than ever. A well-thought-out investment plan is not just a way to grow your wealth; it’s a strategic tool to build financial security, achieve life goals, and leave a lasting legacy. This blog explores how smart investments can empower your financial future, the importance of choosing the right investment plan, and the key factors to consider when evaluating investment options.

How Smart Investments Can Empower Your Financial Future

Smart investments are the cornerstone of a stable and prosperous future. Here’s how they can make a difference:

Wealth Growth

By allocating your resources wisely, your investments can grow exponentially over time, thanks to compound interest and market growth. This ensures your money works for you and keeps up with inflation.

Financial Security

Investments act as a safety net, providing you with a cushion during unexpected financial challenges. Diversifying your portfolio can help mitigate risks and protect your financial well-being.

Achieving Goals

From buying a home and funding education to planning a dream vacation or retirement, smart investments enable you to turn your aspirations into reality.

Passive Income

Certain investment options, like fixed deposits or dividend-paying stocks, offer regular income, giving you financial freedom and flexibility.

Building a Legacy

Investments can secure your family’s future, providing them with opportunities and resources for years to come.

The Importance of Choosing the Right Investment Plan

Selecting the right investment plan is crucial to aligning your financial strategies with your goals. Here’s why it matters:

- Tailored to Your Goals: A suitable investment plan ensures that your financial objectives, whether short-term or long-term, are achievable.

- Risk Management: Different plans come with varying risk levels. The right plan balances your risk tolerance with your desired returns.

- Optimized Returns: A well-chosen plan maximizes your returns while keeping your investments secure.

- Peace of Mind: Knowing your investments align with your future needs gives you confidence and peace of mind.

Things to Consider When Evaluating Investment Options

Choosing the right investment plan requires careful evaluation. Here are some key factors to keep in mind:

Your Financial Goals

Define what you want to achieve. Are you saving for retirement, a child’s education, or a significant purchase? Your goals will shape your investment strategy.

Risk Appetite

Understand your tolerance for risk. High-risk options, like stocks, may offer higher returns, while low-risk options, like fixed deposits, provide stability.

Time Horizon

Consider how long you can leave your money invested. Long-term investments often yield higher returns, while short-term options are ideal for immediate needs.

Return on Investment (ROI)

Evaluate the potential returns of different options. Ensure they align with your expectations and financial goals.

Liquidity

Determine how easily you can access your funds when needed. Investments with high liquidity are essential for emergencies.

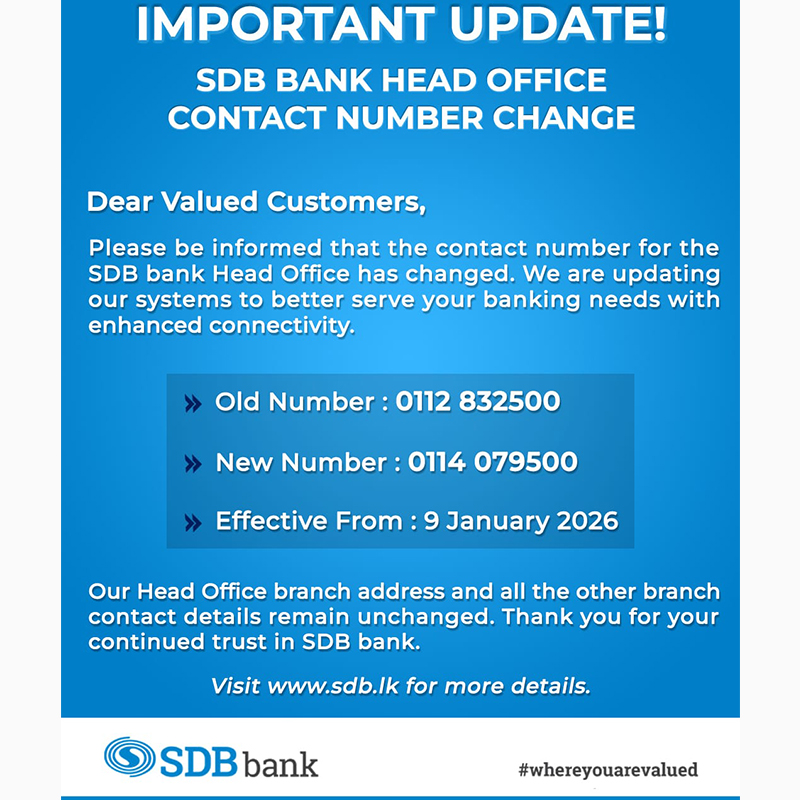

Reputation of the Financial Institution

Partner with trusted institutions, like SDB bank, that offer secure and reliable investment options tailored to your needs.

Investing is not just about growing your wealth-it’s about creating a life of stability, opportunity, and security. By choosing the right investment plan and making informed decisions, you can ensure a brighter tomorrow for yourself and your loved ones. Start your investment journey with SDB bank today and take the first step toward building a secure future. Let’s shape your financial future together!

- No. 12. Edmonton Road

Kirulapone

Colombo 06

Sri Lanka. - 011 5411 411

-

↑

↑