8-June-2022

Sri Lanka faces one of the worst economy crises seen in decades. The country has an immense amount of debt, soaring inflation and a lack of necessities such as fuel, grains, and medicine. The International Monetary Fund (IMF) has begun having conversations about how they can best support the country by working closely on their economic policy.

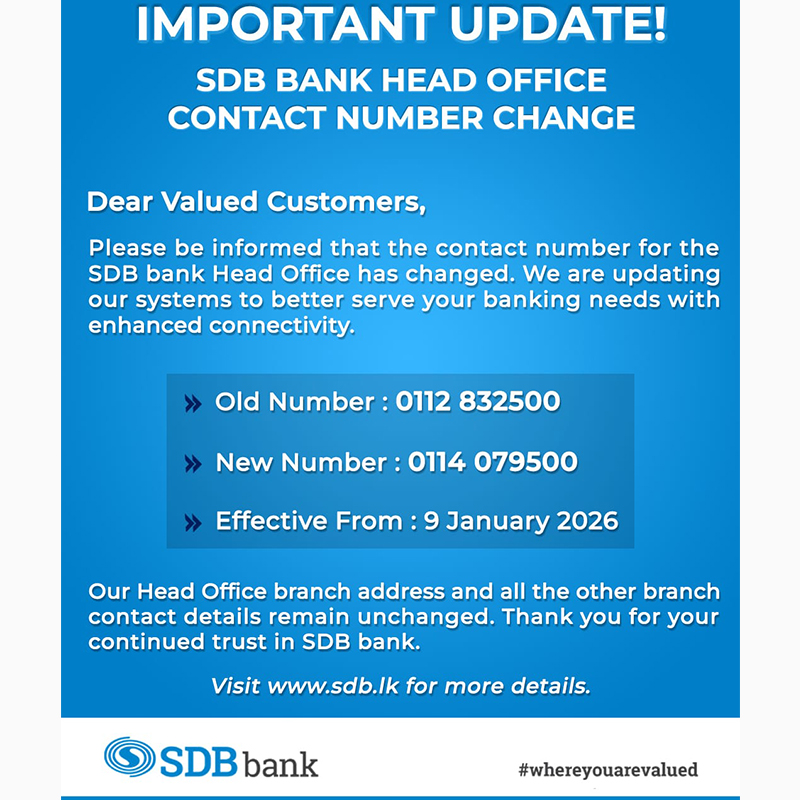

Despite the current situation, Global Alliance for Banking on Values member SDB bank continued to support their clients and achieved outstanding financial results in 2021, gaining a 9% rise in profits. Intrigued by how well the bank did in such an inferior situation, we spoke with the bank’s CEO, Niranjan Thangarajah, to learn more.

A development bank that focuses on the real economy

SDB bank is a Sri Lankan development bank founded in 1997. The bank contributes to uplift the economy by providing banking products and services to micro, small and medium sized enterprises. SDB bank has gone on to affect an unprecedented level of grass-roots economic development by stimulating SME and MSME growth countrywide.

“ESG is in our DNA”, says Niranjan Thangarajah. The foundation of the bank, from the very beginning, was based on how the bank could help society, especially the rural society. Today, they are also working with SMEs, which they believe are the main source of development for the country and for progress. “Even before the ESG concept grew over the years, this bank had it in its DNA.”

The current economic crisis and light at the end of the tunnel

Thangarajah explained how the economic crisis arose. “If you look at the Sri Lankan economy, it has more of a solvency challenge, than a liquidity challenge. When I say solvency, it's to do with debt. That's why you will see announcements that the country's going to debt restructuring.

If you go to the origin of the problem, the Sri Lankan economy has been more of an import-driven economy. If you look at the development in the past, it was stimulated by debt to make Sri Lanka a tourism and transportation hub. Unfortunately, the debt was not well structured.

These two elements heavily influenced the current economic crisis. However, as Covid-19 hit the country, the country lost its mainstream of revenue, tourism. This was the tipping point. As the IMF program comes out, we expect things to be painful and difficult in the short run, but we see light at the end of the tunnel.”

A values-based banking model

“There is a clear solution for the current problem in the country. The solution is to increase your production base, get people to produce, get people to add value. As banks and institutions, that's what we should be investing in and supporting, backing people who are producing today. Once that is done, you're self-dependent, self-sufficient and the problem is resolved.”, explains Thangarajah.

In the past, SDB has been focusing more on imports for consumption, today it supports that national requirement. “I would call it an urgent national requirement of encouraging local valuation and production. We are doing that, they're already there. I see that as a big opportunity for the bank. We are very well positioned to do that well.”

When asked if having a values-based banking model that focused on the real economy helped the bank survive and thrive in this environment, Thangarajah agreed and added: “If you ask me how we did well during these times and how we intend to do better is mainly because of that, because we see a big opportunity in the country which always existed. Values-based banking has helped us because we are adding value. When I say adding value, I mean we are a bank which are close with the rural society. We are focused on inclusivity, getting everyone into the banking system. We are also applying digital. I think we have invested a lot on the digital side, as a bank there, which takes digital banking to the masses”.

All those things put together has helped the bank today to be where it is. “I think we're in a very strong position. I think we will be one of the few well-capitalized banks in the country, in a situation like now. We are a small development bank, with a lot of potential ahead.”

Being a part of the GABV

Thangarajah talks about why SDB joined the GABV in 2020 and the value it has added to their network. “We joined the GABV to mark our presence in a global forum and to share and learn from other’s experiences. As everything is constantly evolving and emerging, we wanted to learn the global trends, and see how we can localise whatever we learn globally. That is the value we see in the GABV.”

As a global network of values-based banks, the GABV strives to showcase how our members are changing lives around the world by putting people and the planet first. Amongst all, we want to emphasize the collective impact we have a movement. Values-based banks put their money where their values lie.

Related Press Releases

- No. 12. Edmonton Road

Kirulapone

Colombo 06

Sri Lanka. - 011 5411 411

-

↑

↑